How Do Sole Traders Pay National Insurance?

How Do Sole Traders Pay National Insurance?

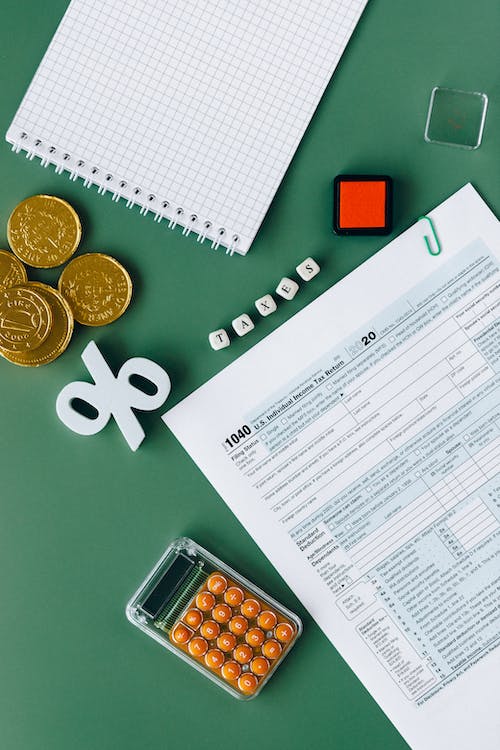

As a sole trader, you will make payments to HMRC for your National Insurance contributions (NICs) through your self-assessment tax return. There are two classes of NICs which can be seen below.

National Insurance Contributions for Sole Traders:

- Class 2 Contributions:

- Class 2 contributions represent flat-rate payments that are obligatory for self-employed individuals.

- The current rate for Class 2 contributions stands at £3.45 per week.

- Class 4 Contributions:

- Class 4 contributions, on the other hand, are determined by the profits generated by your business..

- The current Class 4 contribution rates are as follows:

- 9% on profits between £12,570 and £50,270

- 2% on profits over £50,270

Reporting NICs through Self-Assessment Tax Return:

To fulfil your NICs obligations, it is crucial to report your contributions accurately through your self-assessment tax return. This annual submission to HM Revenue & Customs provides a comprehensive overview of your business income, allowable expenses, and ultimately, the taxable profits on which your NICs are calculated.

For further information please follow this think- https://www.gov.uk/self-employed-national-insurance-rates

*Figures contained above are based on the 2023/2024 tax year.