Understanding Helpbox UK: Our Accounts Production Process

Understanding Helpbox UK: Our Accounts Production Process

At Helpbox UK, we pride ourselves on delivering exceptional accounting services tailored to meet the unique needs of our clients. Our accounts production process is designed to ensure that your financial records are accurate, tax-efficient, and compliant with HMRC regulations. Here’s a step-by-step overview of how we manage your accounts from start to finish.

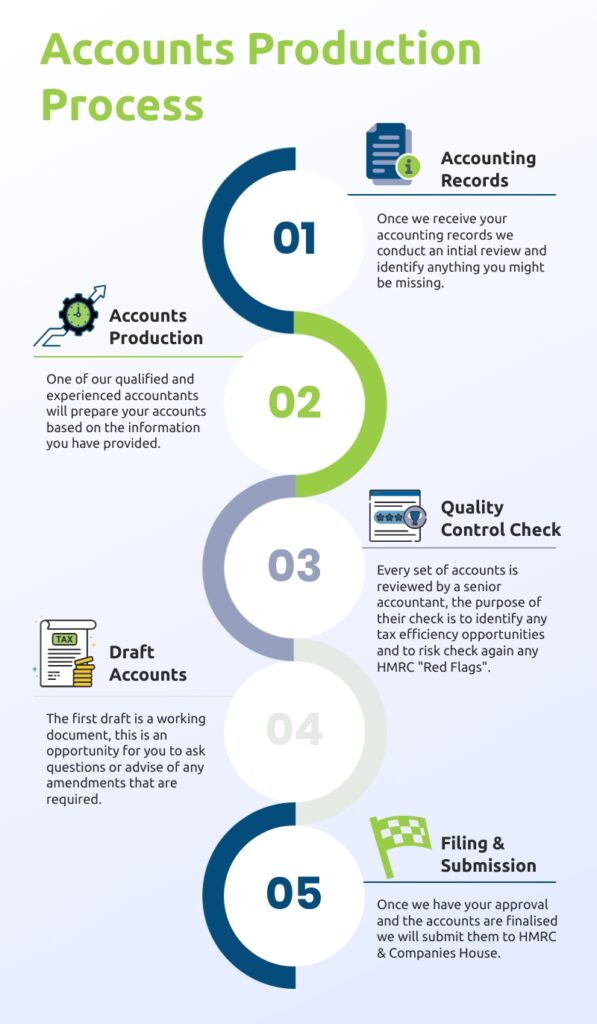

Step 1: Initial Review of Accounting Records

The process begins once we receive your accounting records. Our team conducts an initial review to ensure that all necessary information is included. We provide detailed checklists of the required accounting information to ensure nothing is missed. This preliminary step is crucial for setting the stage for accurate and comprehensive accounts preparation.

We also send out regular reminders relating to your financial year end, so you know exactly what period this information is for and when it’s due by. This way, you’ll never miss a deadline or be at the mercy of HMRC.

| Type of Record Keeping: | Information Required: |

| Accounting Software | Software Used Business Bank/Credit Card Statements |

| Bookkeeping (Paper/Electronic Documents) | Business Bank/Credit Card Statements Sales Invoices Purchase/Expense Invoices Cash Payments Made/Received |

| Spreadsheet | Business Bank/Credit Card Statements *Excel Spreadsheet Summary |

*Spreadsheet Template (VAT) – https://www.helpboxuk.com/wp-content/uploads/2023/10/SPREADSHEET-TEMPLATE.xls

*Spreadsheet Template (Non-VAT) – https://www.helpboxuk.com/wp-content/uploads/2023/10/SPREADSHEET-TEMPLATE-NON-VAT.xls

Step 2: Accounts Production

One of our qualified and experienced accountants will prepare your accounts based on the information you have provided. This involves compiling and organizing your financial data to create a clear and accurate representation of your financial position. Our goal is to prepare accounts that are not only accurate but also reflect your business’s financial health effectively.

During the production phase, we normally advise that it take us 4-6 weeks to complete your initial set of draft accounts. If you have an urgent requirement that needs to be met however, we can offer to prepare the accounts on a priority basis within 2-4 weeks. We understand for requests such as Mortgage Applications and Loan Applications, the turnaround times can be quite tight, so we’ll do what we can to make sure you get this in time!

We also offer unlimited support and guidance whilst processing the accounts for you, so if you do require any help during this stage, please feel free to get in touch with us. Your call will be answered and you’ll be put through to your dedicated account manager who will be best equipped to handle your queries.

Step 3: Quality Control Check

Every set of accounts is reviewed by a senior accountant. The purpose of this thorough review is twofold: to identify any opportunities for tax efficiency and to conduct a risk check against potential HMRC “Red Flags.” Our senior accountants leverage their extensive experience to ensure that your accounts are both compliant and optimized for tax purposes.

Step 4: Draft Accounts Review

The first draft of your accounts is a working document. This stage provides an opportunity for you to review the accounts, ask questions, and request any necessary amendments. We believe in maintaining open communication with our clients to ensure that you are fully informed and satisfied with the preparation of your accounts.

During this step, we’ll provide you with an opportunity to book in a meeting with the accountant that has prepared these for you. This will give you the opportunity to understand your business finances to a greater extent and ask any question you may have.

Step 5: Filing and Submission

Once you approve the final version of your accounts, we proceed with the submission to HMRC and Companies House. Our team handles all aspects of the filing process, ensuring that your accounts are submitted accurately and on time.

Additional Measures: Checklists and Red Flags

To further ensure the accuracy and compliance of your accounts, we utilise detailed checklists and identify potential “Red Flags.” These are areas of risk that might trigger an investigation from HMRC. Our proactive approach involves raising these issues with you and suggesting appropriate actions before filing. Several members of our team are former HMRC employees, bringing valuable insights that enhance our processes.

Tax Efficiency Focus

Our accountants are skilled at structuring your accounts in the most tax-efficient way possible. Our aim is to ensure that you never pay more tax than you should. We also look for tax-deductible items you might have missed, maximizing your potential savings.

Our bespoke accounts production process is designed to provide you with peace of mind. By ensuring accuracy, compliance, and tax efficiency, we help you focus on what you do best—running your business. Contact us today to learn more about how we can assist you with your accounting needs.